CORPORATE GOVERNANCE REPORT

COMPANY’S PHILOSOPHY ON CODE OF GOVERNANCE

Your Company is of the belief that sound Corporate Governance is vital to enhance and retain stakeholder trust. Good Governance underpins the success and integrity of the organisation, institutions and markets. It is one of the essential pillars for building an efficient and sustainable environment, systems and practices to ensure that the affairs of the Company are being managed in a way which ensure accountability, transparency, fairness in all its transactions in the widest sense and meeting its stakeholder’s aspirations and societal expectations. Your Company is committed to adopt the best governance practices and their adherence in the true spirit at all times. It envisages the attainment of a high level of transparency and accountability in the functioning of the Company and in the way it conducts business internally and externally.

In line with the above philosophy, your Company continuously strives for excellence through adoption of best governance and disclosure practices. The Company recognises that good governance is a continuing exercise and thus reiterates its commitment to pursue highest standard of Corporate Governance in the overall interest of its stakeholders.

Your Company has been consistently working for the betterment of the governance system executed with the Stock Exchanges. We are committed to doing things in the right way which includes but not limited to compliance with its applicable legal requirement.

THE HIGHLIGHT OF THE CORPORATE GOVERNANCE SYSTEM INCLUDES:

- The Board of Directors of the Company is well represented with Executive, Non-Executive and Independent NonExecutive Directors with the Executive Chairman and Managing Director. As on the date of this report, the Independent Non-Executive Directors form about 62% of the Board of Directors.

- The Board has constituted several Committees viz. Audit Committee, Nomination and Remuneration Committee, Stakeholders Relationship Committee, Corporate Social Responsibility Committee and Executive Sub Committee for more focused attention. The Board is empowered to constitute additional functional Committees from time to time, depending on the business needs.

- The Company has established a Code of Conduct for Directors and Senior Management of the Company.

- Whistle Blower Policy wherein the Employees and Directors may have the direct access to the Chairperson of the Audit Committee.

- Risk Management framework to identify the risk for its businesses, to assess the probability of its occurrence and its mitigation plans. The information about the framework is placed before the Audit Committee and the Board periodically.

The Company is managed and guided by the Board of Directors (“Board”). The Board formulates the strategy, regularly reviews the performance of the Company and determines the purpose and values of the Company. The Board provides and evaluates the strategic direction of the Company, management policies and their effectiveness and ensures that the long-term interests of the shareholders are being served. The Chairman and Managing Director with the support of the Vice Chairman and Managing Director and senior executives oversees the functional matters of the Company.

As on the date of this report, the Board comprises of eight (8) Directors - 5 (five) Non-Executive and Independent Directors including one Women Director, 1(one) Non Executive Non-Independent Director and 2 (two) Executive Directors. All the members of the Board are eminent persons with professional expertise and valuable experience in their respective areas of specialisation and bring a wide range of skills and experience to the Board.

None of the Directors on the Board is a Member on more than 10 Committees, and Chairperson of more than 5 Committees across all listed companies in which he is a Director. Necessary disclosures regarding Committee positions have been made by the Directors.

Meetings of the Board

The Board of Directors met six times during the FY 20 ended on March 31, 2020. The interval between any two successive meetings did not exceed one hundred and twenty days. Board Meetings were held on May 21, 2019, June 3, 2019, August 3, 2019, November 8, 2019, February 4, 2020 and February 10, 2020.

Independent Directors

All the Independent Directors have confirmed that they meet the criteria as stipulated under Regulation 16(1)(b) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’) read with Section 149(6) of the Companies Act, 2013 (‘Act’). All such declarations were placed before the Board. Based on that, in the opinion of the Board, they fulfill the conditions of independence as specified in the Listing Regulations and the Act and are independent of the management. The maximum tenure of independent directors is in compliance with the Companies Act, 2013 and the terms and conditions of their appointment have been disclosed on the website of the Company.

Regulation 25(3) of Listing Regulations read with Schedule IV of the Companies Act, 2013 and the rules under it mandate that the Independent Directors of the Company hold at least one meeting in a year without the attendance of Non-Independent Directors of the Company and members of the management. During the year, separate meeting of the Independent Directors was held on February 4, 2020 without the attendance of nonindependent directors and members of the management. The independent directors, inter-alia reviewed the performance of non-independent directors, Chairman of the Company and the Board as a whole.

All the Directors including Independent Directors are provided with the necessary documents / brochures, reports and internal policies, codes of conduct to enable them to familiarise with the Company’s procedure and practices. Directors are regularly updated on performance of each line of business of the Company, business strategy going forward and new initiatives being taken / proposed to be taken by the Company through presentation. Factory visits are organised, as and when required, for the Directors. The details of the familiarisation programme of the Independent Directors are available on the Company’s website at http://www.trivenigroup.com/investor/ corporate-governance/policies.html

Board of Directors

The Nomination and Remuneration Committee (NRC) of the Board shall identify the suitable person for appointment at Board level including from the existing top management. The NRC shall apply due diligence process to determine competency of person(s) being considered for appointment or re-appointment as a Director including Managing Director / Whole-time Director of the Company in accordance with the provisions of the Nomination and Remuneration Policy of the Company and the applicable provisions of the Companies Act, 2013 and the Rules made thereunder and the SEBI (LODR) Regulations, 2015, as amended from time to time.

Senior Management

The Managing Director(s) / Executive Director (s) are empowered to identify, appoint and remove the Senior Management Personnel in accordance with the provisions of the NRC Policy, and keeping in view the organization’s mission, vision, values, goals and objectives.

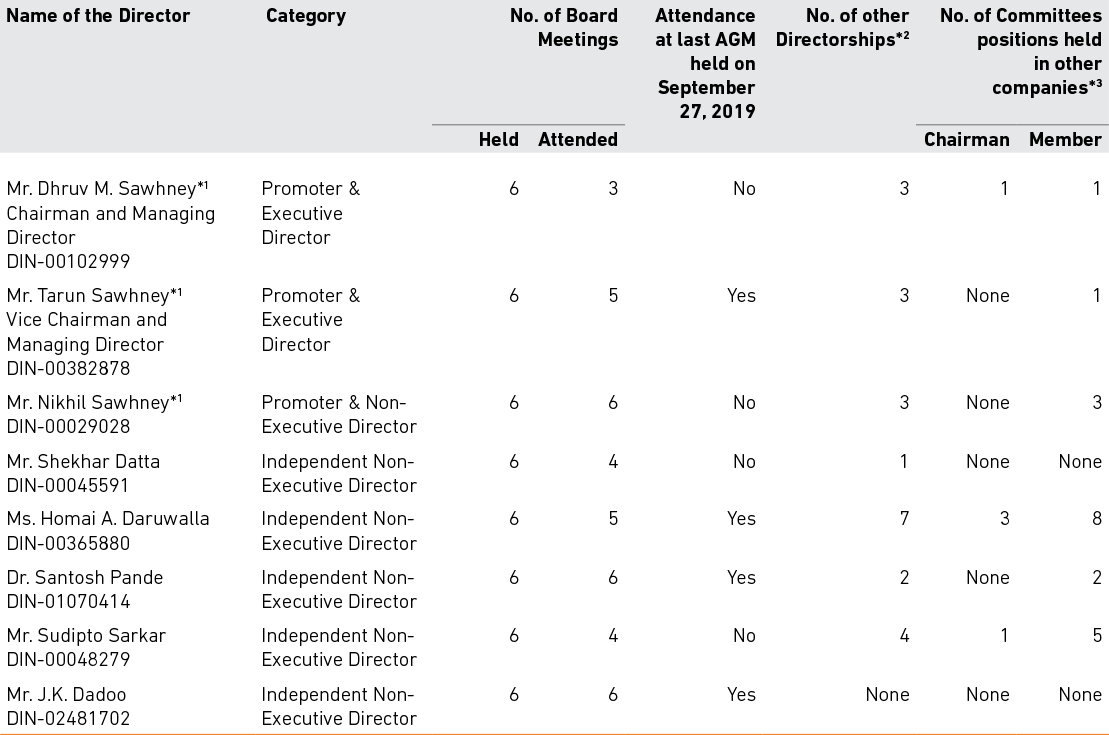

The composition of the Board of Directors, their attendance at Board Meetings held during the year and at the last Annual General Meeting (AGM) as also the details of Directorships and Committee positions held by them in other companies are given below:-

Lt. Gen. K.K. Hazari (Retd.) (DIN:00090909) and Dr. F.C. Kohli, (DIN:00102878), Independent Non-Executive Directors, resigned from the Board w.e.f. November 8, 2019 and January 24, 2020 due to health reasons and advancing age respectively and there was no other material reason for their resignation.

*1 Mr. Tarun Sawhney and Mr. Nikhil Sawhney are sons of Mr. Dhruv M. Sawhney, Chairman & Managing Director of the Company and are thus related.

*2 Excludes Directorships in Indian Private Limited Companies, Foreign Companies, Firms, Partnerships including LLPs, Section 8 Companies and membership of various Chambers and other non-corporate organisations.

*3 The committees considered for the purpose are those prescribed under Regulation 26(1) of Listing Regulations i.e. Audit Committee and Stakeholders’ Relationship Committee of public limited companies, whether listed or not. Further, No. of Committee membership includes Committee Chairmanships.

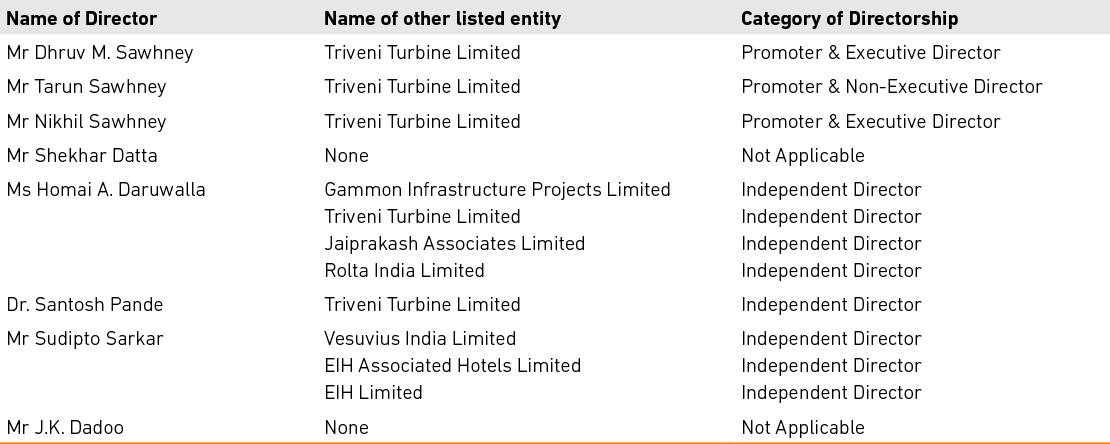

Further, the details of directorship held by the Directors of the Company in other listed entities as on the date of this report are as follows:-

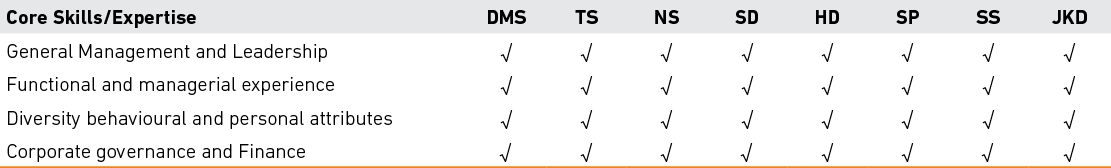

Matrix of skills/ expertise/ competence of the Board of Directors

The Board comprises qualified members who bring in the required skills, competence and expertise that allow them to make effective contribution to the Board and its committees.

Details of the core skills/ expertise/ competencies identified by the board of directors as required in the context of the Company’s business(es) and sector(s) in which it operates to function effectively:

General management and leadership experience*: This includes experience in the areas of general management practices and processes, business development, strategic planning, global business opportunities, manufacturing, engineering, financial management, information technology, research and development, senior level experience and academic administration.

Knowledge, Functional and managerial experience*: Knowledge and skills in accounting and finance, business judgment, crisis response and management, industry knowledge, formulating policies and processes, legal & administration, sales and marketing, supply chain, risk management & internal controls, financial & operational controls.

Diversity & Behavioural and Personal attributes: Diversity of thought, experience, perspective, gender and culture brought to the Board by individual members. Personal characteristics matching the Company’s values, such as ethics & integrity, accountability, commitment, building relationship.

Corporate governance and Finance: Understanding of good corporate governance practices & regulatory framework applicable to the Company and its compliances, maintaining board and management accountability, protecting stakeholders’ interests and Company’s responsibilities towards customers, employees, suppliers, regulatory bodies and the communities in which it operates, financial skills, oversight for risk management and internal controls and proficiency in financial management.

*These skills/competencies are broad-based, encompassing several areas of expertise/ experience. Each Director may possess varied combinations of skills/experience within the described set of parameters, and it is not necessary that all Directors possess all skills/ experience listed therein.

Given below is a list of core skills, expertise and competencies of the individual Directors:

DMS – Mr. Dhruv M. Sawhney, TS – Mr. Tarun Sawhney, NS – Mr. Nikhil Sawhney, SD – Mr. Shekhar Datta, HD – Ms Homai Daruwalla, SP – Dr Santosh Pande, SS – Mr. Sudipto Sarkar, JKD – Mr J.K. Dadoo

The Board and its Committees meet at regular intervals for discussion on agenda circulated well in advance by the Company. All material information is incorporated in the agenda for facilitating meaningful and focused discussion at the meeting. Where it is not practical to attach or send the relevant information as a part of agenda papers, the same are tabled at the Meeting. To meet business exigencies, resolutions in respect of urgent matters are passed by the Directors by Circulation.

The Company has proper systems to enable the Board to periodically review compliance reports of all laws applicable to the Company, as prepared by the Company as well as steps taken by the Company to rectify instances of non-compliances. The Board reviewed compliance reports prepared by the Company on quarterly periodicity

Presentation by the Management

The senior management of the Company is invited at the meetings to make presentations to the Board, covering operations of the businesses of the Company, Strategy and Business Plans and to provide clarifications as and when necessary.

Access to Employees

The Directors bring an independent perspective on the issues deliberated by the Board. They have complete and unfettered access to any information of the Company and to any employee of the Company

Availability of Information to Board Member includes:

- Performance of each line of business, business strategy going forward, new initiatives being taken / proposed to be taken and business plans of the Company.

- Annual operating plans and budgets including capital expenditure budgets and any updates.

- Quarterly results of the Company including results of the business segments.

- Minutes of the meetings of Committees of the Board.

- The information on recruitment and remuneration of senior officers just below the Board level, including appointment or removal of Chief Financial Officer and the Company Secretary.

- Show cause, demand, prosecution notices and penalty notices which are materially important.

- Fatal or serious accidents, dangerous occurrences, any material effluent or pollution problems.

- Any material default in the financial obligations to and by the Company, or substantial non-payment for goods sold / services provided by the Company.

- Any issue, which involves possible public or product liability claims of substantial nature, including any judgment or order which, may have passed strictures on the conduct of the Company or taken an adverse view regarding another enterprise that can have negative implications on the Company.

- Details of any joint venture or collaboration agreement.

- Transactions that involve substantial payment towards goodwill, brand equity, or intellectual property.

- Significant labour problems and their proposed solutions. Any significant development in Human Resources / Industrial Relations front like signing of wage agreement, implementation of Voluntary Retirement Scheme etc.

- Sale of material nature, of investments, subsidiaries, assets, which is not in normal course of business.

- Quarterly details of foreign exchange exposures and the steps taken by the management to limit the risks of adverse exchange rate movement, if material.

- Non-compliance of any regulatory, statutory nature or listing requirements and shareholders servicing issues, such as non-payment of dividend, delay in share transfer etc.

- Statutory compliance report of all laws applicable to the Company.

- Details of the transactions with the related parties.

- General notices of interest of directors.

- Appointment, remuneration and resignation of Directors.

Post Meeting follow up Mechanism

The important decisions taken at the Board / Committee meetings are promptly communicated to the respective units/ departments. Action taken report on the decisions of the previous meeting(s) is placed at the immediately succeeding meeting of the Board/ Committee for information and review by the Board.

Re-appointment of Director

The information / details pertaining to Director seeking reappointment in ensuing Annual General Meeting (AGM), is provided in the Notice for the AGM. The Notice contains the relevant information, like brief resume of the Directors, nature of their expertise in specific functional areas and names of the companies in which they hold Directorship and membership of any Committee of the Board.

The Board of Directors have constituted following Committees consisting of Executive and Non-Executive Directors of the Company with adequate delegation of powers to meet various mandatory requirements of the Act and Listing Regulations and perform as also to oversee business of the Company and to take decisions within the parameters defined by the Board. The Company Secretary acts as the Secretary to all the Committees of the Board:

- Audit Committee

- Nomination and Remuneration Committee

- Stakeholders’ Relationship Committee

- Corporate Social Responsibility Committee

Details on the role and composition of these committees, including the number of meetings held during the financial year and the related attendance are provided below:

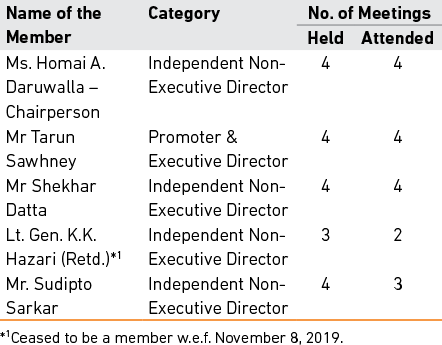

(I) Audit Committee Composition, Meetings & Attendances

The Committee is headed by an Independent Director and consists of the members as stated below. During the year ended on March 31, 2020, the Audit Committee met four times i.e. on May 21, 2019, August 2, 2019, November 7, 2019 and February 4, 2020. The composition and attendance of each Audit Committee Member is as under:

The Chairperson of the Audit Committee attended the last AGM held on September 27, 2019 to answer the shareholders’ queries.

The functions and terms of reference/role of the Audit Committee as specified in the Regulation 18 of the SEBI (LODR) Regulations and Section 177 of the Companies Act, 2013 as amended from time to time and broadly include:-

The terms of reference of the Committee inter-alia include:-

- Reviewing the Company’s financial reporting process and its financial statements.

- Reviewing the accounting and financial policies and practices and compliance with applicable accounting standards.

- Reviewing the efficacy of the internal control mechanism, monitor risk management policies adopted by the Company and ensure compliance with regulatory guidelines.

- Reviewing reports furnished by the internal and statutory auditors, and ensure that suitable followup action is taken.

- Examining accountancy and disclosure aspects of all significant transactions.

- Reviewing with management the quarterly, half yearly & annual financial statements including review of qualifications, if any, in the audit report before submission to the Board for approval.

- Recommending appointment of external and internal auditors and fixation of audit fees.

- Seeking legal or professional advice, if required

- Approval or any subsequent modifications of transactions of the Company with related parties.

- Scrutiny of Inter-Corporate loans and investments.

- Valuation of undertakings or assets of the Company, wherever required.

- Reviewing the utilization of loans and/or advances from/investment by the holding company in the subsidiary exceeding Rupees 100 crore or 10% of the asset size of the subsidiary, whichever is lower including existing loans / advances / investment.

The constitution and term of reference of the Audit Committee meet the requirements of Regulation 18 of the Listing Regulations read with the relevant provisions of the Companies Act, 2013.

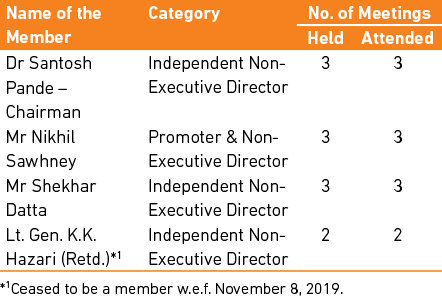

(II) Nomination and Remuneration Committee (NRC) Composition, Meetings & Attendance

The NRC is headed by an Independent Director and consists of the members as stated below. The NRC met thrice during the FY 20 ended on March 31, 2020 i.e. on May 21, 2019, August 2, 2019 and February 4, 2020. The NRC was reorganized on September 23, 2019 by redesignating Dr Pande as Chairman in place of Gen. Hazari. The composition and attendance of each Audit Committee Member is as under:-

The broad terms of reference of the NRC include:

- To identify persons who are qualified to become Directors (Executive, Non-Executive and Independent Directors) and who may be appointed in senior management in accordance with the criteria laid down.

- To recommend to the Board their appointment and removal and shall carry out evaluation of every director’s performance.

- To formulate the criteria for determining qualifications, positive attributes and independence of a director and recommend to the Board a policy, relating to the remuneration for the directors (Executive, Non-Executive and Independent Directors), key managerial personnel and other employees.

- Plan for succession of Board members and Key Managerial Personnel;

- Devising a policy on Board diversity;

- To formulate, administer and supervise the Company’s Employee Stock Option Schemes (ESOP Schemes) including grant of stock options under the ESOP Schemes to the permanent employees of the Company from time to time in accordance with SEBI Guidelines/Regulations; and

- To review the adequacy of aforesaid terms of reference and recommend any proposed change to the Board for its approval.

The constitution and term of reference of the NRC meet the requirements of Regulation 19 of the Listing Regulations read with the relevant provisions of the Companies Act, 2013 and the SEBI ESOP Guidelines/Regulations.

Remuneration Policy

In terms of the provisions of the Companies Act, 2013 and the Listing Regulations, the Board of Directors of the Company has adopted Nomination and Remuneration Policy for nomination and remuneration of Directors, Key Managerial Personnel (KMP) and Senior Management. The Nomination and Remuneration Committee inter-alia recommends the remuneration of Executive Directors, which is approved by the Board of Directors, subject to approval of the shareholders, wherever necessary. The Chairman and Managing Director and Vice Chairman and Managing Director evaluates the Senior Management Personnel, including KMPs considering the competencies/ indicators provided in the Remuneration Policy. The Nomination and Remuneration Policy is available on the Company’s website at http://www.trivenigroup.com/ investor/corporate-governance/policies.html

Performance Evaluation Criteria for Independent Directors

The Nomination and Remuneration Committee has laid down the criteria for evaluation of performance of Independent Directors based on the indicators provided in the Remuneration Policy. The performance evaluation of Independent Directors (IDs) was done by the entire Board of Directors, excluding the ID being evaluated, based on parameters, such as, number of meetings attended, inputs and contribution made, independence of judgement, effectiveness etc.

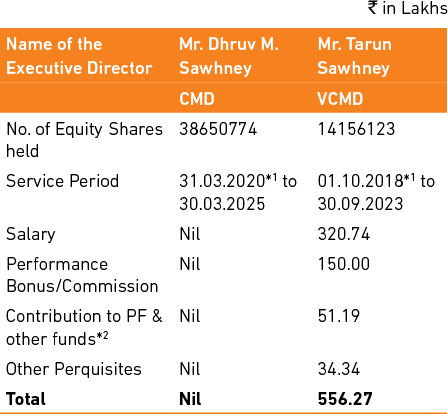

Remuneration to Executive Directors

The remuneration to the Executive Directors is recommended by the Nomination and Remuneration Committee to the Board and after approval by the Board, the same is put up for the Shareholders approval. Executive Directors do not receive any sitting fees for attending the Board and Committee meetings.

During the FY 20 ended on March 31, 2020, the Company had two Executive Directors viz. Mr. Dhruv M Sawhney, Chairman and Managing Director (CMD) and Mr. Tarun Sawhney, Vice Chairman and Managing Director (VCMD).

The details of remuneration paid/payable to CMD and VCMD during the FY 20 ended on March 31, 2020 are as under:

*1 date of re-appointment. There is no notice period and no severance fees.

*2 does not include gratuity as it is provided based on actuarial valuation.

During the year, Mr Dhruv M. Sawhney has not drawn any remuneration from this Company in his capacity as Chairman and Managing Director of the Company. He has drawn remuneration from Triveni Turbines DMCC, Dubai (UAE), a foreign step-down subsidiary of an Associate Company, Triveni Turbine Ltd. (TTL). The remuneration drawn by Mr Tarun Sawhney is within the ceiling prescribed under the Companies Act, 2013, Listing Regulations and in accordance with the approval of the Board and the Shareholders of the Company.

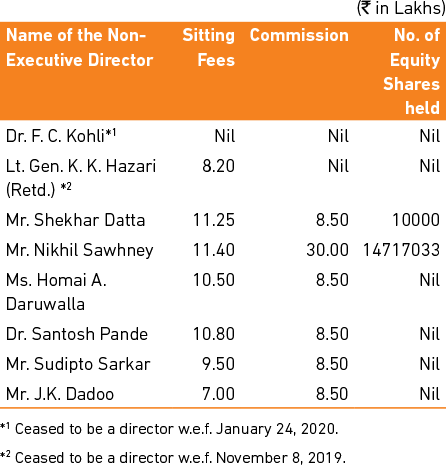

Remuneration to Non-Executive Directors (NEDs)

The Company pays sitting fee to its NEDs for attending the meetings of the Board and its Committees within the limits prescribed under the provisions of the Companies Act, 2013. In addition to the sitting fees, the NEDs are entitled to profit based commission within the limits approved by the shareholders of the Company. The said commission is decided by the Board and distributed to NEDs based on their performance.

The details of the remuneration paid/provided during the FY20 ended on March 31, 2020 to NEDs are as follows:-

None of the Independent / Non-Executive Directors have any pecuniary relationship or transactions with the Company, its promoters and its senior management, its subsidiaries and associate companies except for the payment of remuneration as stated above. Mr. Shekhar Datta, Dr. Santosh Pande, and Ms Homai A. Daruwalla, Independent Directors have received sitting fee / commission as Director and Member of Board/ Committees of Triveni Turbine Ltd. (Associate Company), whereas Mr. Nikhil Sawhney, Promoter & Non-Executive Director is the Vice Chairman and Managing Director of the said Associate Company and has drawn remuneration from that Company.

During the year, the Company has not issued any Stock Option to the Directors including Independent Directors under its ESOP Schemes.

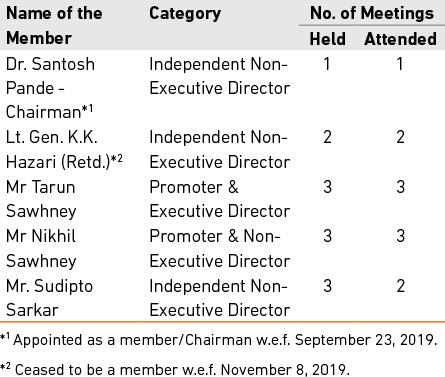

(III) Stakeholders’ Relationship Committee (SRC) Composition, Meetings & Attendance

The Committee is headed by an Independent Director and consists of the members as stated below. The Committee met thrice during the FY 20 ended on March 31, 2020 i.e. on May 21, 2019, August 2, 2019, and November 8, 2019. The SRC was reconstituted on September 23, 2019 by inducting Dr. Santosh Pande as a Member & designating him as Chairman in place of Gen. Hazari. The composition and attendance of each Committee Member is as under:-

Function and term of reference

The functions and terms of reference/role of the SRC broadly include:-

- Resolving the grievances of the security holders of the listed entity including complaints related to transfer/ transmission of shares, non-receipt of annual report, non-receipt of declared dividends, issue of new/ duplicate certificates, general meetings etc.

- Review of measures taken for effective exercise of voting rights by shareholders.

- Review of adherence to the service standards adopted by the company in respect of various services being rendered by the Registrar & Share Transfer Agent.

- Review of the various measures and initiatives taken by the Company for reducing the quantum of unclaimed dividends and ensuring timely receipt of dividend warrants/annual reports/statutory notices by the shareholders of the Company.

- Review of the report(s) which may be submitted by the Company Secretary/RTA relating to approval /confirmation of requests for share transfer/ transmission/ transposition/ consolidation/issue of duplicate share certificates/sub-division, consolidation, remat, demat etc on quarterly basis.

The constitution and term of reference of the Stakeholders’ Relationship Committee meet the requirements of Regulation 20 of the Listing Regulations read with the relevant provisions of the Companies Act, 2013. Ms. Geeta Bhalla, Group Vice President & Company Secretary has been designated as the Compliance Officer of the Company.

Details of investor complaints

During the FY 20 ended on March 31, 2020, the Company received complaints from various shareholders / investors directly and/or through the Stock Exchanges / SEBI relating to non-receipt of dividend / redemption money, annual report/notice of general meeting, new share certificates etc. All of them were resolved / replied suitably by furnishing the requisite information / documents. Details of investor complaints received and resolved during the FY 20 are as follows:

Further, there were no pending share transfers and requests for dematerialization as on March 31, 2020.

(IV) Corporate Social Responsibility Committee (CSR Committee)

Composition, Meetings & Attendance

The Committee is headed by an Independent Director and consists of four members, viz. Ms. Homai A. Daruwalla – Chairperson, Dr. Santosh Pande, Mr Tarun Sawhney and Mr Nikhil Sawhney. During the FY 20 ended on March 31, 2020, the CSR Committee met once on August 2, 2019 and all the members attended the said meeting.

Function and term of reference

The CSR Committee is authorized to formulate and recommend to the Board, a CSR policy indicating the activity or activities to be undertaken by the Company as specified in Schedule VII of the Companies Act, 2013; recommend the amount to be spent on such activities; monitor the Company’s CSR policy periodically and institute a transparent monitoring mechanism for the implementation of the CSR projects.

The constitution and term of reference of the CSR Committee meet the requirements of relevant provisions of the Companies Act, 2013.

Other Committees

Executive Sub-Committee

Apart from the above statutory committees, the Board of Directors have constituted an Executive Sub-Committee comprising of four (4) Directors to oversee routine matters that are in the normal course of the business. The Board of Directors have delegated certain powers to this Committee to facilitate the working of the Company. The Committee met four times during the FY20 ended on March 31, 2020.

Particulars of the last three Annual General Meetings are as follows:

(a) Details of the Special Resolution passed by the Company through Postal Ballot:

During the FY 20 ended on March 31, 2020, the Company has not sought approval from its shareholders for passing of any special resolution through Postal Ballot.

(b) Whether any special resolution is proposed to be conducted through postal ballot:

There is no immediate proposal for passing any special resolution through postal ballot on or before ensuing Annual General Meeting.

(c) Procedure for Postal Ballot:

The Company endeavours to follow the procedure laid down under the relevant provisions of the Act read with rules thereof and the provisions of the Listing Regulations as and when there is any proposal for passing resolutions by postal ballot.

(a) Quarterly Results: The Unaudited quarterly / half yearly financial results and the annual audited financial results of the Company were published in National English and Hindi newspapers and displayed on the website of the Company at www. trivenigroup.com and the same were also sent to all the Stock Exchanges where the equity shares of the Company are listed. The Investor’s brief were also sent to Stock Exchanges.

(b) Website www.trivenigroup.com: Detailed information on the Company’s business and products; quarterly / half yearly / nine months and annual financial results, Investor brief and the quarterly distribution of Shareholding are displayed on the Company’s website.

(c) Teleconferences and Press conferences, Presentation etc.: The Company held quarterly Investors Teleconferences and Press Conferences for the investors of the Company after the declaration of the Quarterly / Annual Results. The Company made presentations to institutional investors / analysts during the period which are available on the Company’s website.

(d) Exclusive email ID for investors: The Company has designated the email id shares@trivenigroup.com exclusively for investor servicing, and the same is prominently displayed on the Company’s website www.trivenigroup.com. The Company strives to reply to the Complaints within a period of 6 working days.

(e) Annual Report: Annual Report contains inter-alia Audited Annual Stand-alone Financial Statement, Consolidated Financial Statement, Directors’ Report and Auditors’ Report. The Management Perspective, Business Review and Financial Highlights are also part of the annual report.

(f) The Management Discussion & Analysis: The Management Discussion & Analysis Report forms part of the annual report.

(g) Intimation to Stock Exchanges: The Company intimates stock exchanges all price sensitive information or such other information which in its opinion are material & of relevance to the shareholders. The Company also submits electronically various compliance reports / statements periodically in accordance with the provisions of the Listing Regulations on NSE and BSE Electronic Filing System.

(a) Annual General Meeting

Day & Date : Monday, September 28, 2020

Time : 11:00 A.M. (IST)

Venue : The Company is conducting the meeting through Video Conferencing/Other Audio Visual Means pursuant to the General Circular dated May 5, 2020 issued by the Ministry of Corporate Affairs

(b) Financial Year : April to March

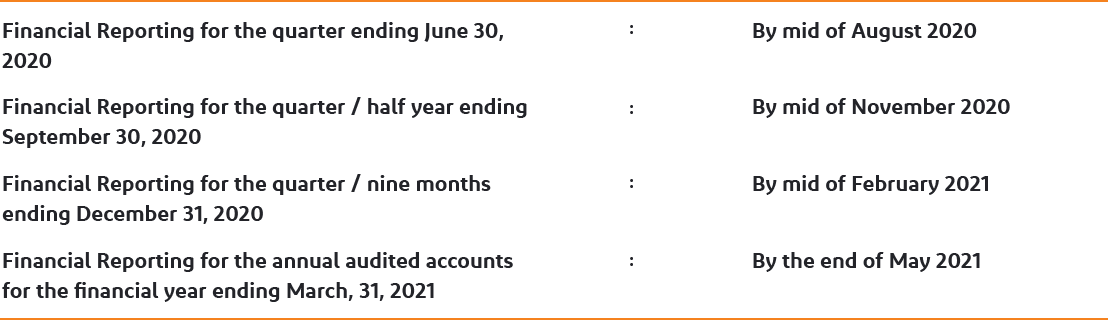

Financial calendar for the financial year 2020-21 (tentative)

(c) Listing on Stock Exchanges

The equity shares of the Company are listed at the following stock exchanges:

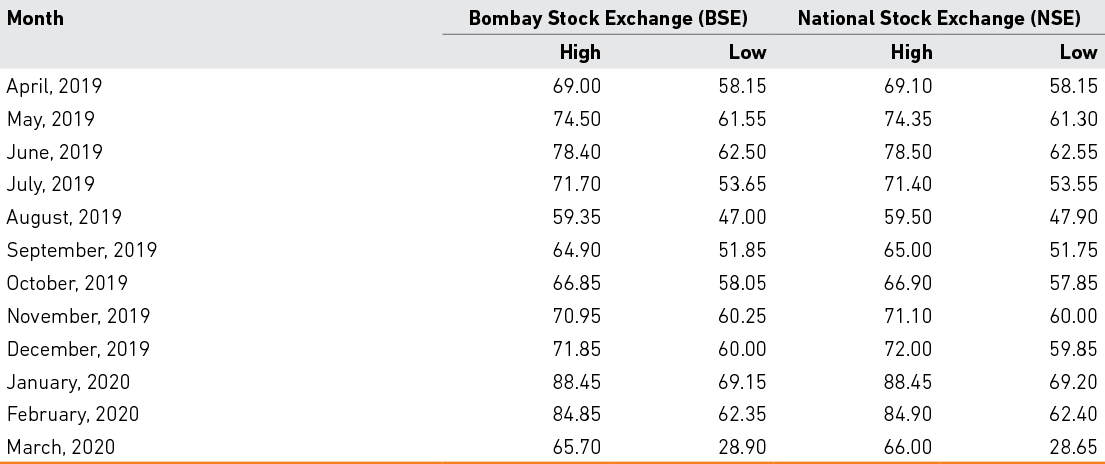

(d) Market Price Data/Stock Performance: FY20

During the year under report, the trading in Company’s equity shares was from April 1, 2019 to March 31, 2020. The high low price during this period on the BSE and NSE was as under:-

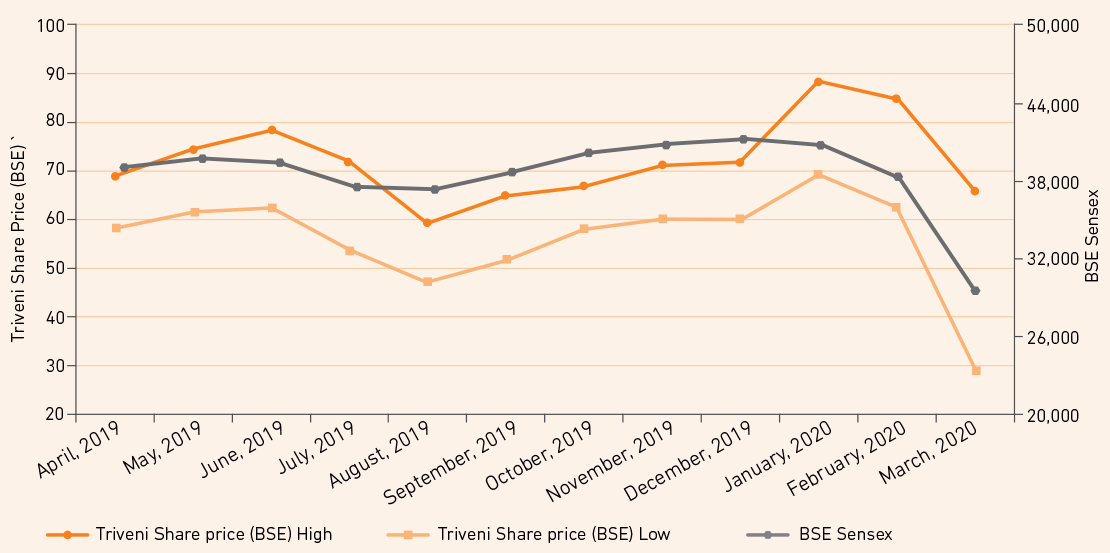

(e) Performance of the share price of the Company in comparison to the BSE Sensex

(f) Registrar & Share Transfer Agent

M/s KFin Technologies Pvt. Ltd., (formerly M/s Karvy Fintech Pvt. Ltd.)

Unit: Triveni Engineering & Industries Limited Karvy Selenium Tower B, Plot 31-32, Gachibowli Financial District, Nanakramguda, Hyderabad – 500 032.

Tel. :- Board No.: 040 6716 2222

Fax No. : 040 23001153

Email : einward.ris@kfintech.com

(g) Share Transfer System

The Company’s share transfer authority has been delegated to the Company Secretary / Registrar and Transfer Agent

M/s KFin Technologies Pvt. Ltd., which generally approves and confirms the request for share transfer / transmission / transposition / consolidation / issue of duplicate share certificates / sub-division, consolidation, remat, demat and perform other related activities in accordance with the Listing Regulations and SEBI (Depositories and Participants) Regulations, 1996 and submit a report in this regard to Stakeholders’ Relationship Committee.

The shares sent for physical transfer are registered and returned within the stipulated period from the date of receipt of request, if the documents are complete in all respects. As per the requirement of regulation 40(9) of the Listing Regulations, a certificate on half yearly basis confirming due compliance of share transfer/transmission formalities by the Company from Practicing Company Secretary has been submitted to Stock Exchanges within stipulated time.

(h) Distribution of Equity Shareholding as on March 31, 2020

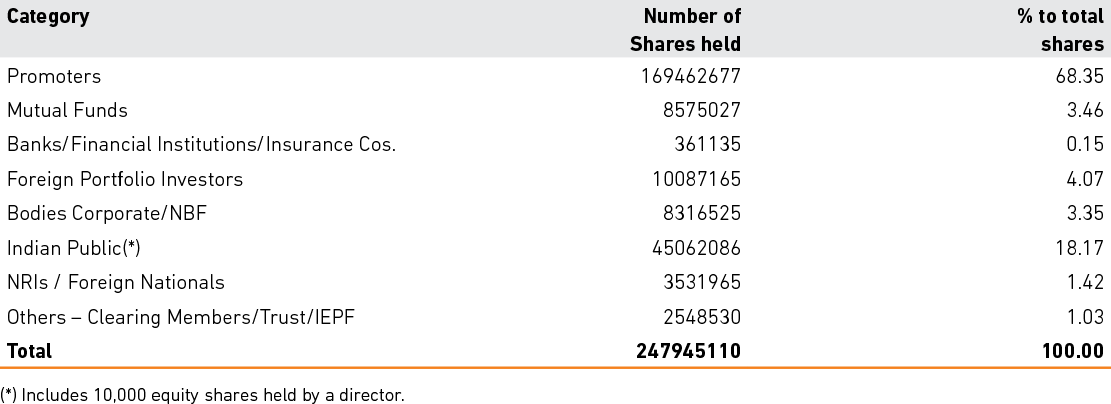

(i) Shareholding Pattern of Equity Shares as on March 31, 2020

(j) Dematerialisation of Shares & Liquidity

The Company’s equity shares are compulsorily traded in the electronic form. The Company has entered into an Agreement with NSDL and CDSL to establish electronic connectivity of its equity shares for scrip less trading. Both NSDL & CDSL have admitted the Company’s equity share on their system.

The system for getting the shares dematerialised is as under:

- Share Certificate(s) along with Demat Request Form (DRF) will be submitted by the shareholder to the Depository Participant (DP) with whom he/she has opened a Depository Account.

- DP will process the DRF and generates a unique number DRN.

- DP will forward the DRF and share certificates to the Company’s Registrar and Share Transfer Agent.

- The Company’s Registrar and Share Transfer Agent after processing the DRF will confirm or reject the request to the Depositories.

- Upon confirmation, the Depository will give the credit to shareholder in his / her depository account maintained with DP.

As on March 31, 2020, 99.90% of total equity share capital of the Company was held in dematerialised form (including 100% of the promoter holding). The ISIN allotted by NSDL / CDSL is INE256C01024. Confirmation in respect of the requests for dematerialisation of shares is sent to NSDL and CDSL within the stipulated period.

(k) Outstanding GDR / ADR or Warrants

As on date there are no Global Depository Receipts (GDR), American Depository Receipt (ADR), Warrants or any other convertible instrument.

(l) Commodity price risk or foreign exchange risk and hedging activities

Barring sugarcane, the price of which is fixed by the Government, the Company is not exposed to any material commodity price risks in respect of other raw materials. In respect of its final products, the Company is exposed to sugar price risk and in view of sugar business being a dominant business of the Company, its impact is substantial. However, the Company does not have significant risks from foreign currency fluctuations as the foreign exposures are nominal. The details on these risks, mitigation and hedging potential thereof are stated in Note 41 of the Standalone Financial Statements and in the Management Discussions & Analysis forming part of the Annual Report.

(m) Reconciliation of Share Capital Audit

As stipulated by SEBI, a qualified Practicing Company Secretary carries out Reconciliation of Share Capital Audit to reconcile the total admitted capital with NSDL and CDSL and the total issued and listed capital. This audit is carried out every quarter and the report thereon is submitted to the Stock Exchanges. The Audit confirms that the total listed and paid-up capital is in agreement with the aggregate of the total number of shares in dematerialised form and in physical form.

(n) Unclaimed Dividend

All unclaimed dividends upto the financial year 2011-12 (Final Dividend) have been transferred to the Investor Education and Protection Fund (IEPF), administered by the Central Government.

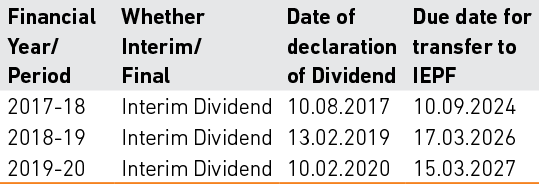

The dividends for the succeeding years remaining unclaimed for 7 years will be transferred by the Company to the said IEPF on the due dates as given hereunder:

Shareholders who have not so far encashed their dividend warrant(s) or have not received the same are requested to seek issuance of duplicate warrant(s) by writing to the Company confirming non-encashment / non-receipt of dividend warrant(s).

(o) Transfer of Equity Shares to Investor Education and Protection Fund (IEPF)

In compliance with the requirements laid down in Section 124(6) of the Companies Act, 2013 read with the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016, the Company has transferred equity shares of all such shareholders whose dividends had remained unpaid or unclaimed for seven consecutive years or more, to the Demat Account of IEPF. However, the shareholders are entitled to claim their equity shares including all the corporate benefits accruing on such shares, if any, from the IEPF Authority by submitting an online application in prescribed Form IEPF-5 and sending a physical copy of the said Form duly signed by all the joint shareholders, if any, as per the specimen signatures recorded with the Company along with requisite documents enumerated in the Form IEPF5, to the Company’s Registrar & Transfer Agent, M/s KFin Technologies Pvt. Ltd., Hyderabad. The Rules and Form IEPF-5 for claiming back the equity shares are available on the website of IEPF www.iepf.gov.in. It may please be noted that no claim shall lie against the Company in respect of equity shares transferred to IEPF pursuant to the said Rules. The details of the shareholders whose equity shares had been transferred to the Demat Account of the IEPF and the details of unclaimed dividends lying with the Company as on the date of last AGM (i.e. Sept 27, 2019) are available on the website of the Company at www. trivenigroup.com/investor/shareholders-information. Further, shares in respect of which dividend will remain unclaimed progressively for seven consecutive years, will be reviewed for transfer to the IEPF as required by law. In the interest of shareholders, the Company send prior intimation to the concerned shareholders to claim their unclaimed dividends in order to avoid transfer of dividend/shares to IEPF and publish a notice to this effect in the newspapers.

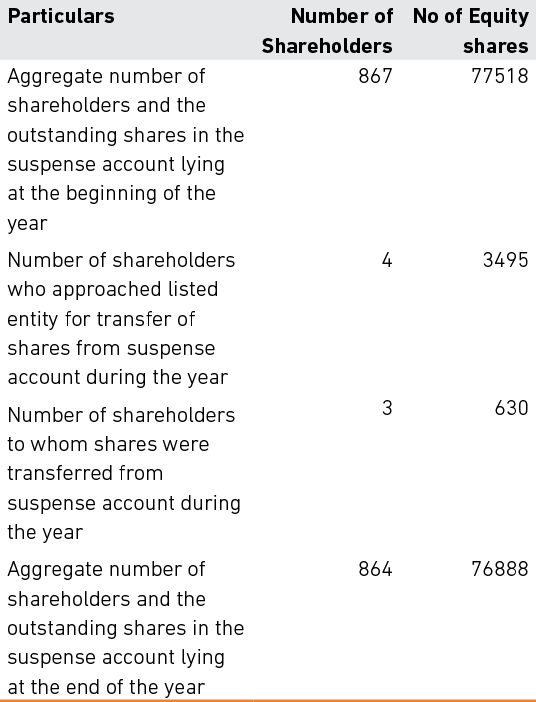

Equity shares of the Company lying in IEPF suspense account

In accordance with the requirement of Regulation 34(3) and Part F of Schedule V to the SEBI (Listing Regulations, detail of the equity shares in the suspense account are as follows:

The voting rights on the shares outstanding in the said account as on March 31, 2020 shall remain frozen till the rightful owner of such shares claims the shares.

p) Locations

Registered Office

Triveni Engineering & Industries Limited Deoband, Distt. Saharanpur

Uttar Pradesh - 247 554

Tel. :- 01336-222185, 222497

Fax :- 01336-222220

Share Department

Triveni Engineering & Industries Ltd. 8th Floor, Express Trade Towers, 15-16, Sector 16A, Noida-201 301.

Tel. :- 0120-4308000; Fax :- 0120-4311010-11

email :- shares@trivenigroup.com

Plant Locations

Detailed information on plant / business locations is provided elsewhere in the Annual Report.

Address for correspondence

Please contact the Compliance Officer of the Company at the following address regarding any questions or concerns:

Ms. Geeta Bhalla

Group Vice President & Company Secretary Triveni Engineering & Industries Ltd. 8th Floor, Express Trade Towers, 15-16, Sector 16A, Noida-201 301.

Tel. :- 0120-4308000; Fax :- 0120-4311010-11

Email :- shares@trivenigroup.com

q) Credit Rating

During the financial year 2019-20, ICRA has, reaffirmed the rating for long term and short term facilities of the Company at AA- and A1+ respectively with stable outlook.

Related Party Transactions

During the year, there was no materially significant related party transaction which may have potential conflict with the interest of the Company. The Company has formulated a Related Party Transaction Policy which has been uploaded on its website at http://www.trivenigroup.com/investor/corporate-governance/policies.html Details of related party information and transactions are being placed before the Audit Committee from time to time. The details of the related party transactions during the year have been provided in Note No.39 to the financial statements.

Disclosures of Accounting Treatment

In the financial statements for the year ended March 31, 2020, the Company has followed the treatment as prescribed in the applicable Accounting Standards.

Disclosures on acceptance of recommendations made by the Board Committees

During the financial year under review, there was no such instance wherein the Board had not accepted any recommendation of the any Committee of the Board. All the recommendations made by the Committees of the Board were accepted by the Board.

Details of Non-Compliance by the Company, penalties, stricture imposed on the Company by the Stock Exchanges, SEBI or any statutory authorities or any matter related to capital markets.

The Company has complied with all the requirements of the Stock Exchanges / the Regulations and guidelines of SEBI and other Statutory Authorities on all matters relating to capital markets. No penalties or strictures have been imposed by SEBI, Stock Exchanges or any statutory authorities on matters relating to capital markets during the last three years.

Whistle Blower Policy and Affirmation that no personnel has been denied access to the Audit Committee

The Company has established a vigil mechanism through a Whistle Blower Policy for directors and employees to report concerns about unethical behavior, actual or suspected fraud or violation of the Company’s code of conduct or ethics policy. The mechanism provides for adequate safeguards against victimisation of director(s)/ employee(s) who express their concerns and also provides for direct access to the Chairperson of the Audit Committee in exceptional cases. During the year under review, no personnel was denied access to the Audit Committee.

Disclosures in relation to The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013

The Company has formulated a policy on prevention of Sexual Harassment in accordance with the provisions of The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 and Rules made thereunder which is aimed at providing every women at the workplace a safe, secure and dignified work environment.

No complaint of sexual harassment was received from any women employee during the year.

Code for prevention of Insider Trading

The Company has formulated comprehensive Code of Conduct to regulate, monitor and report trading by Insiders in line with the SEBI (Prohibition of Insider Trading) Regulations, 2015 as amended. The Code lays down the guidelines which advise on procedures to be followed and disclosures to be made, while dealing in shares of the Company and the consequences of non-compliances, including the policy for enquiry in case of leak or suspected leak of Unpublished Price Sensitive Information (‘UPSI’). The Company has also adopted Code for Fair Disclosure of UPSI along with Policy for Determination of Legitimate Purposes and the same is available on the Company’s website at http://www.trivenigroup.com/investor/ corporate-governance/policies.html

Code of conduct for Directors and Senior Executives

The Company has laid down a Code of Conduct for all Board Members and the Senior Executives of the Company. The Code of conduct is available on the Company’s website www.trivenigroup.com. They have affirmed their compliance with the said code of conduct for the financial year ended March 31, 2020. A declaration to this effect duly signed by the Chairman and Managing Director is given below:

To the Shareholders of

Triveni Engineering & Industries Ltd.

I hereby declare that all the Board Members and the Senior Management Personnel have affirmed compliance with the Code of Conduct as adopted by the Board of Directors and applicable to them for the financial year ended March 31, 2020.

Date: June 17, 2020

Place: New Delhi

Dhruv M. Sawhney

Place: New Delhi Chairman and Managing

Certification

The Chairman and Managing Director and Group CFO have certified to the Board of Directors, inter-alia, the accuracy of financial statements and adequacy of internal controls for the financial reporting purpose as required under Regulation 17 (8) of Listing Regulations, for the year ended March 31, 2020. The said certificate forms part of the Annual Report.

Further, as required under Regulation 34(3) and Schedule V Para C clause (10)(i) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015), a certificate from the Company Secretary in Practice has been received stating that none of the Directors on the Board have been debarred or disqualified from being appointed or continuing as Directors of Companies by the Board / Ministry of Corporate affairs or any such statutory authority. The said certificate forms part of the Annual Report.

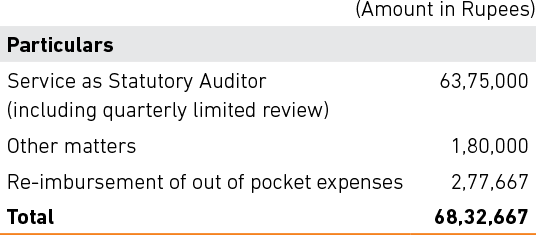

Remuneration to Statutory Auditors

M/s S S Kothari Mehta & Co. (Firm Registration No. 000756N), are holding the office of Statutory Auditors of the Company and one of its wholly owned subsidiaries namely, Mathura Wastewater Management Pvt. Ltd. The particulars of payment of Statutory Auditors fees on consolidated basis is given below:

Details of compliance with mandatory requirements and adoption of the non-mandatory requirements

The details of mandatory requirements are mentioned in this Report. The Company is in compliance with the requirements specified under regulations 17 to 27 and clauses (b) to (i) of sub-regulation (2) of regulation 46 of the Listing Regulations, as applicable, with regard to corporate governance.

The status of adoption of the discretionary requirement as prescribed in Schedule II Part E of the Listing Regulations is as under:

Modified opinion(s) in audit report

The opinion expressed by the Auditor in the audit report on the financial statements for the year ended March 31, 2020 is unmodified.

Subsidiary Companies

There are seven unlisted Indian wholly owned subsidiary companies viz. Triveni Industries Ltd., Triveni Engineering Ltd., Triveni Energy Systems Ltd., Triveni Entertainment Ltd., Svastida Projects Ltd., Mathura Wastewater Management Pvt. Ltd. and Triveni Sugar Ltd. None of these subsidiaries is the “Material Non-listed Subsidiary” in terms of Regulation 16(1)(c) of the Listing Regulations. The Company regularly places before the Board, minutes of the unlisted subsidiaries of the Company. The Company has a policy for determining Material Subsidiary which has been uploaded on its website at http://www.trivenigroup. com/investor/corporate-governance/policies.html

Disclosure of commodity price risks and commodity hedging activities

With respect to inputs, the Company is not exposed to any material commodity price risks. However, with respect to the outputs, the Company is exposed to risks relating to the sugar price. In view of lack of adequate depth in commodity exchange/s in India, there is little potential of effective hedging but the Company strives to minimise the risk by an effective sales strategy

The certificate dated June 17, 2020 from Statutory Auditors of the Company (M/s SS Kothari Mehta & Co.) confirming compliance with the Corporate Governance requirements as stipulated under the Listing Regulations is annexed hereto.

The above report has been adopted by the Board of Directors of the Company at their meeting held on June 17, 2020.

For and on behalf of the Board of Directors

Place: New Delhi

Date : June 17, 2020

Dhruv M. Sawhney

Chairman and Managing Director

DIN: 00102999

2020 Triveni Engineering, All Rights Reserved

Design & Developed by RDX Digital Pvt. Ltd.